Every January, we at TTC haul out our crystal ball, test the market, examine all the trend reports, and then present our predictions for the coming year. Of course, by the time we get to that point, most experts have pontificated, editorial calendars have been printed and many prophecies, self-fulfilling and otherwise, emerge or crash and burn. At TTC, we try to get beyond the obvious; and sometimes deliberately seek literally, ‘the edge’.

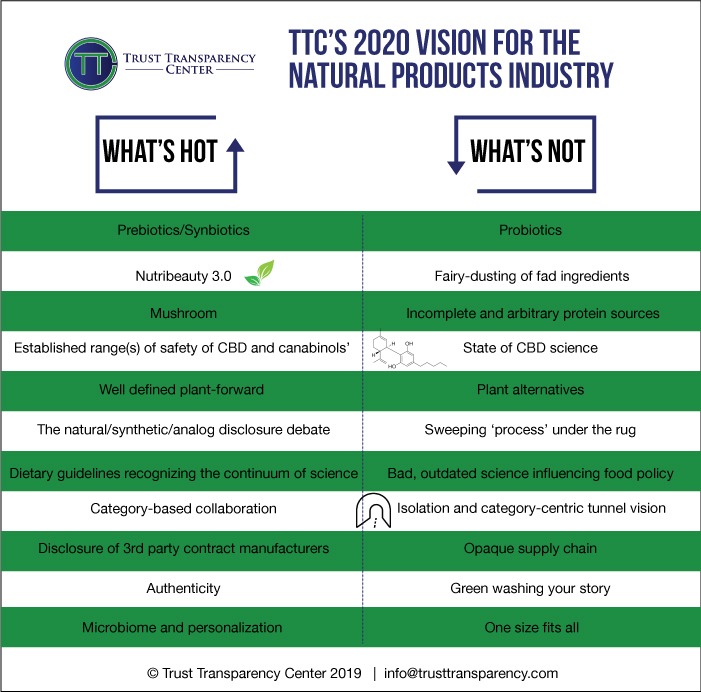

In January, when we published our ‘What’s Hot and Not’ list, no one was even dimly aware of an important new factor that would change our lives, economies and health priorities. We made our bold prophecies against the prevailing micro and macro-trends; some have borne out, and many more appear to have dropped in both priority and urgency.

On our ‘what’s hot’ list we documented prebiotics and synbiotics, mushroom products, and Mintel’s recently proclaimed darling of the nutra universe, collagen and nutribeauty. We were on point with all three of these. Prebiotic awareness and interest continue to grow, accelerated by the immune uptick earlier this year, and also part of a general wave of interest associated with another one of our hot areas – the microbiome. Plus, as companies brand extend from probiotics alone, we are seeing more interest in synbiotics. So, we’ll consider that a win. Mushrooms also benefited from the immune focus of recent months and articles like this Insider piece have helped raise their profile. On the nutribeauty and collagen front, perhaps nothing points out the future potential of this category more than the Nestle acquisition of Vital Proteins.

The combination of personalization and the microbiome is another one of those dynamic duos, and the first half of 2020 has seen a continued acceleration of microbiome research, as the microbiome gets implicated in more mechanisms associated with immunity and inflammation. We are starting to see the emergence of synbiotics and prebiotics intended to address population groups and type, so while not ‘n=1’ personalization, certainly a move towards targeted supplement delivery based on diagnostics and metabolomics.

Remember CBD? We said that we’d see advances in proving the safety of CBD products. Well, not so much although this week, the US House did pass a bill that would allow US troops to use CBD products. This is some movement, even if dialogue between industry and FDA has languished and FDA itself does not appear to have made much of an advance in its thinking about how to effectively regulate CBD products. CBD largely though has been bumped from the news for the better part of 2020. In our ‘what’s not’, we said we did not expect to see industry-led new science. Guess we got that one right, although it’s so tough to actually do the research in the current gray zone of official regulation.

Back to our projected ‘What’s hots, we predicted further definition and stratification in the plant-based market. It’s a pretty ambiguous prediction, arguably being delivered, or certainly well on its way. Our next big prediction was more transparency and pressure on disclosure of synthetic ingredients; as it turns out, if our recent survey is any indication, we missed on that one too. Our next ‘what’s hot’ prediction was rather hopeful and is closely tied to what we hoped was not going to happen. It had to do with the 2020 debate on nutrition science and the US dietary guidelines. We hoped we would see a rethinking and refreshing use of emerging science along a continuum that gradually expands knowledge in the space. Instead, and this was vocally called out by process critics, the committee retrenched itself in debunked science and really did not take solid steps forward in crafting the healthful and practical guidelines many had hoped for. So we still have bad science influencing bad food policy.

The other elements we were looking for as we gazed into 2020 were more behavioral and here reader, you’ll have to help us out. We were looking for more category-based collaboration (things like category-based research and messaging), more supply chain transparency like disclosure of country of origin, contract manufacturers and contract labs, and ever-increasing authenticity. Maybe I’m just a tad jaded, but I’m not sure we’ve seen those last three increase appreciably. The first, ‘collaboration’, was also reflected in our ‘what’s not’ – isolation.

There were several areas that we thought had crested or were hoping to see active steps to eliminate certain behaviors. The current crisis has created new opportunities for ‘fairy dusting’ of ingredients and outright adulteration as the predictable experience of elderberry suppliers proves. If popularity of an ingredient can be exploited, bottom feeders in our industry will do so.

All in all, we didn’t totally miss the mark for the year, and have probably teased out a few long plays. Obviously, we missed the current crisis, the buoying of immunity products and the resulting health halo benefit across much of the supplement universe. We’ll also double-down on personalization now, not the n=1 diagnostic-based kits that technology can now provide, but a really deep dive into “what do I need, for me and mine, right now, my most important decision, because I need to make these decisions, matter more than ever.”

Another observation of note, confirmed with many industry contacts – for the past 6 months, true product ‘de novo’ innovation has often been placed on hold. It was ‘triage’ for many companies to keep supply chains operating and warehouses as full as possible. We did see ingredients added to formulations to support brand extensions, but few new ingredient suppliers qualified for true new product development and release. We’re now into the ‘what’s new’ period, and the next 6 months and into 2021will produce true new products. That’s not to say that supply chain rethinking and repatriation won’t occur, it’s that new product development will be done with a mind to risk limiting the supply chain.

We get a mixed mark so far this year, how about you?